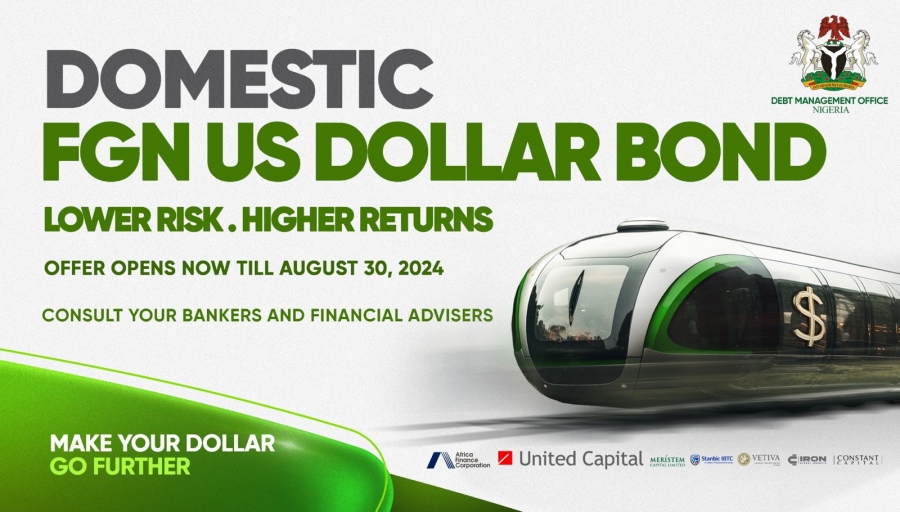

United Capital Group has achieved a historic milestone by leading the issuance of Nigeria’s first-ever domestic U.S. dollar-denominated bond. This significant financial maneuver has successfully raised over $900 million, marking a pivotal moment in the country’s economic landscape. The issuance not only underscores Nigeria’s growing financial sophistication but also sets a precedent for future capital market innovations.

United Capital’s Role in the Bond Issuance

As the Lead Issuing House and Coordinator, United Capital played a crucial role in orchestrating this landmark bond issuance. Their expertise and strategic planning were instrumental in navigating the complexities of the financial markets. By aligning with the Federal Government’s objectives, United Capital ensured the bond’s successful launch, attracting significant investor interest.

Significance of the Dollar Bond

This domestic dollar bond issuance represents a groundbreaking step for Nigeria’s financial sector. It provides an alternative funding source, helping to diversify the nation’s financial portfolio. Moreover, the dollar denomination offers a hedge against currency fluctuations, appealing to both local and international investors seeking stable returns.

Impact on Nigeria’s Economy

The successful bond issuance is expected to have far-reaching impacts on Nigeria’s economy. The raised funds can bolster infrastructure projects, drive economic growth, and enhance investor confidence. By tapping into the international capital markets, Nigeria can leverage these funds to address critical development needs, ultimately fostering a more robust economic environment.

Challenges and Opportunities

Despite the successful issuance, challenges remain. The bond market’s volatility and geopolitical uncertainties pose risks. Nevertheless, this issuance opens up new opportunities for Nigeria to engage with global investors. By demonstrating financial resilience and transparency, Nigeria can attract further investments, paving the way for future economic advancements.

The Role of Financial Institutions

Financial institutions like United Capital are pivotal in facilitating such landmark deals. Their role extends beyond mere coordination, encompassing risk assessment, market analysis, and investor engagement. By leveraging their expertise, these institutions contribute significantly to the financial sector’s evolution, supporting national economic objectives.

Future Prospects for Dollar Bonds in Nigeria

The success of this inaugural dollar bond sets the stage for future issuances. With a successful track record, Nigeria is well-positioned to explore additional dollar-denominated instruments. This move could enhance liquidity in the financial markets, offering diverse investment opportunities and strengthening the country’s economic standing.

Conclusion: A New Era in Nigerian Finance

The issuance of Nigeria’s first domestic dollar bond, led by United Capital, marks a transformative moment in the country’s financial history. It underscores the potential of Nigeria’s capital markets to innovate and attract global investments. As Nigeria continues to navigate the complexities of the global financial landscape, such initiatives will be crucial in driving sustainable economic growth and development.