Nigeria’s Bold Tax Shift: N800/$ Customs Duty

A Leap Towards Economic Stability

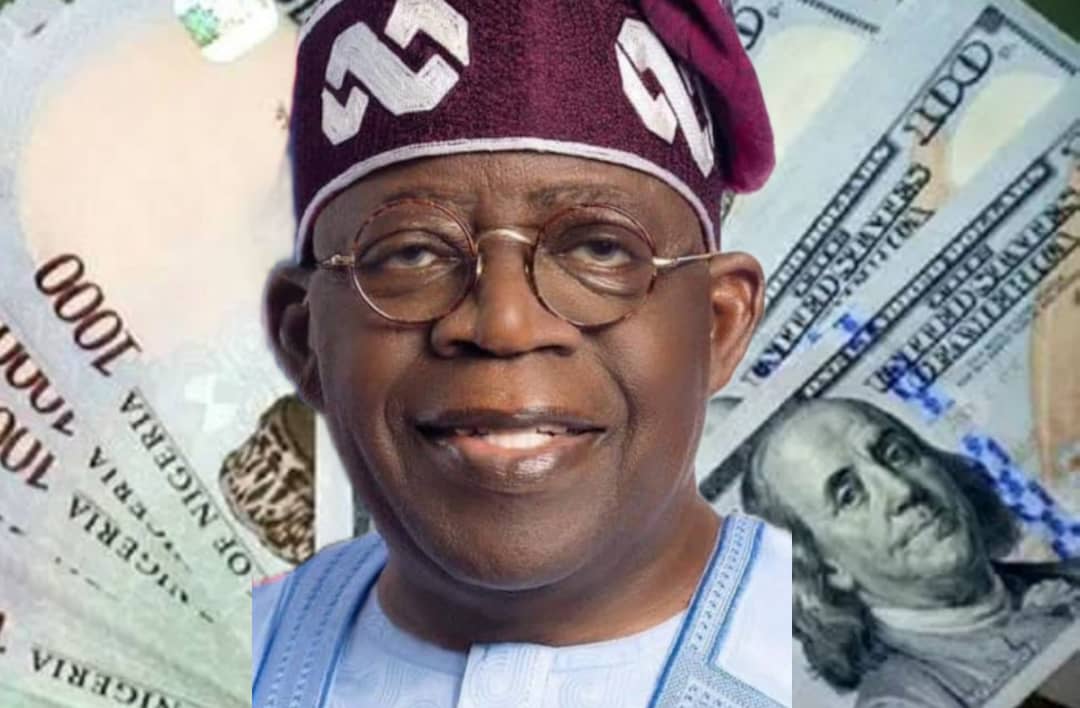

In a decisive move, Nigeria’s Presidential Committee on Fiscal Policy and Tax Reforms has recommended a fixed exchange rate of N800 per US dollar for customs import duty1. This bold step is aimed at providing much-needed stability in the nation’s volatile foreign exchange market.

The Rationale Behind the Recommendation

The committee, led by Taiwo Oyedele, has taken a stand against the erratic changes in customs duty, which have been as frequent as twice a day1. Such unpredictability has been a thorn in the side of businesses, making planning a nightmare.

The Impact on Business Planning

Oyedele’s words resonate with the business community: “People need to plan.” By proposing a fixed rate for the rest of the year, the committee is offering a lifeline to businesses struggling with the current economic unpredictability1.

A Unified Tax Vision

The recommendation goes hand in hand with a broader vision for tax reform. The committee suggests collapsing over 100 different tax collection agencies into one central body, the Nigerian Revenue Service1. This move could streamline tax collection and reduce bureaucratic hurdles.

The Future of Fiscal Policy

The committee’s proposal extends beyond customs duty. They advocate for zero-based budgeting and long-term appropriation, aiming to restructure the budget to prioritize infrastructure and human capital investment1.

Conclusion: A Step Towards Predictability

The recommendation of a fixed N800/$ customs duty rate is a significant stride towards economic predictability. It reflects a commitment to fostering a stable environment for businesses and could mark the beginning of a new chapter in Nigeria’s fiscal policy.