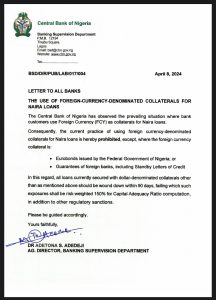

In a surprising turn of events, the Central Bank of Nigeria (CBN) has made a significant policy change. The apex bank has issued a directive to all Nigerian banks, instructing them to cease the practice of accepting foreign currencies as collateral for loans issued in naira.

This move marks a significant shift in the country’s banking sector. Previously, banks could accept foreign currencies as collateral, providing a safety net for loans issued in the local currency, the naira. However, this practice will no longer be permissible under the new directive.

The CBN’s decision is seen as a bold move to strengthen the naira and reduce the country’s reliance on foreign currencies. It’s a step towards promoting financial stability and fostering a robust and resilient banking sector that can withstand economic shocks.

While the immediate impact of this policy change on the banking sector and the broader economy is yet to be fully understood, it’s clear that it will have far-reaching implications. Banks will need to adjust their lending practices and risk management strategies to comply with the new directive.

The CBN’s decision is expected to encourage banks to explore other forms of collateral and may lead to increased innovation in the sector. It could also prompt a re-evaluation of lending practices, potentially leading to more stringent loan approval processes.

However, the move has also raised concerns. Critics argue that it could make it more difficult for businesses and individuals to secure loans, particularly those who rely on foreign currency assets as collateral. There are also worries that it could exacerbate existing challenges in the country’s foreign exchange market.

In conclusion, the CBN’s decision to discontinue the acceptance of foreign currencies as collateral for naira loans is a significant policy shift. While it presents challenges, it also offers opportunities for innovation and growth in the banking sector. As with any major policy change, the ultimate impact will depend on how well the sector adapts to the new landscape.

This is a developing story, and we will continue to provide updates as more information becomes available. Stay tuned for more insights on this critical shift in Nigeria’s banking sector.