Stock Surge and Earnings Report

On December 13, 2024, Broadcom’s stock surged by nearly 23%, pushing its market capitalization beyond the trillion-dollar mark for the first time. This surge followed an optimistic earnings report where CEO Hock Tan outlined substantial growth projections for the company’s AI segment. Broadcom anticipates a revenue opportunity of between $60 billion and $90 billion by 2027, positioning itself as a key player in the expanding AI landscape.

Rapid Growth in AI Revenue

The semiconductor giant reported that its AI revenue more than tripled last fiscal year, reaching an impressive $12.2 billion. This growth resulted from a staggering 220% increase in demand for processors and networking components essential for AI applications. As tech giants like Microsoft and Meta invest heavily in custom AI infrastructures, Broadcom’s specialized chips have become indispensable.

Positive Outlook for Future Sales

During a recent conference call, Tan emphasized that Broadcom expects a 65% increase in AI product sales for the upcoming fiscal quarter. This projection significantly outpaces the overall semiconductor sector’s expected growth of around 10%. Such a bullish outlook indicates Broadcom’s robust pipeline and ability to meet surging demand from data center operators and hyperscalers.

Navigating Industry Challenges

The semiconductor industry has faced numerous challenges in recent years, including supply chain disruptions and chip shortages exacerbated by global events. However, as companies pivot towards AI-driven solutions, Broadcom has positioned itself to thrive amidst these challenges. The firm’s extensive portfolio includes custom chip designs that cater specifically to data centers, vehicles, smartphones, and internet access equipment.

Strategic Acquisitions Fuel Growth

Broadcom’s recent success is not merely a product of favorable market conditions; it is also a testament to strategic acquisitions and innovations under Tan’s leadership. The acquisition of VMware Inc. for approximately $69 billion has strengthened Broadcom’s software division, which now approaches parity with its semiconductor business. This diversification allows Broadcom to offer comprehensive solutions that address various technological needs across industries.

Competitive Landscape

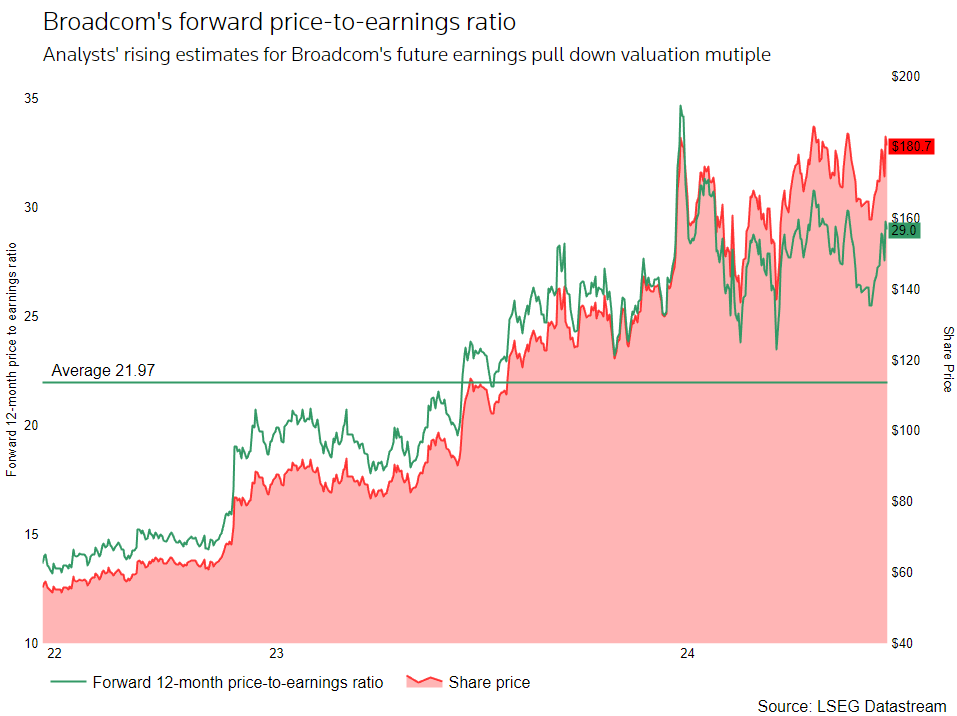

As competition intensifies within the semiconductor space, particularly from companies like Nvidia, Broadcom’s ability to adapt and innovate will be crucial. Analysts have noted that while Nvidia remains a dominant player in AI processors, Broadcom’s lower price-to-earnings ratio makes it an attractive investment option. With its shares rising over 60% this year alone, investor confidence in Broadcom’s future prospects continues to grow.

Broader Trends in Semiconductor Demand

The forecasted growth in AI revenue aligns with broader trends in the semiconductor industry. Demand for advanced chips is surging due to increased investments in high-performance computing (HPC) and edge computing solutions. Companies are leveraging AI technologies not only to enhance their products but also to optimize manufacturing processes and supply chains.

Operational Efficiency Through AI

For instance, AI-driven predictive analytics are revolutionizing how semiconductor manufacturers manage inventory and forecast demand. By utilizing historical data and real-time analytics, companies can minimize overstocking or shortages that disrupt production cycles. This operational efficiency is vital as manufacturers strive to keep pace with rapid technological advancements.

A Bright Future Ahead

Looking ahead, Broadcom’s prospects appear bright as it continues to secure partnerships with major hyperscalers while expanding its product offerings. The company recently announced it had gained two significant new customers among large data center operators—an indication of its growing influence in this critical market segment.

As Broadcom navigates this transformative period within the semiconductor industry, it remains committed to delivering innovative solutions that meet evolving customer needs. The company’s focus on AI technology positions it well for sustained growth as businesses increasingly integrate AI into their operations.

The achievement of reaching a trillion-dollar valuation underscores not only Broadcom’s success but also reflects broader trends within the technology sector as it adapts to meet the demands of an increasingly digital world. As we move forward into 2025 and beyond, all eyes will be on how Broadcom leverages its position to drive innovation and capture market share in this dynamic landscape.