Nigerian Breweries Reports 159% Increase in Pre-Tax Losses Amid Economic Struggles

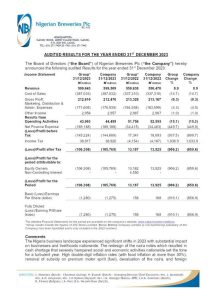

Nigerian Breweries Plc has announced a shocking 159.7% rise in pre-tax losses for the first nine months of 2024. This alarming figure raises concerns about the financial health of the brewing giant. The company’s financial statement, released on October 24, shows pre-tax losses increasing from ₦78.16 billion last year to ₦202.99 billion this year. This surge highlights the challenges businesses face in Nigeria, especially in the beverage sector, which struggles with inflation and foreign exchange issues.

Despite these losses, Nigerian Breweries reported a significant revenue increase. Revenue rose to ₦710.87 billion from ₦401.87 billion year-on-year. This impressive growth of about 74.66% stands in stark contrast to the company’s rising costs. The cost of sales surged to ₦500.95 billion, reflecting a staggering 100.9% increase compared to last year.

A major factor behind this financial downturn is the steep rise in foreign exchange losses, which increased by 84.4% to ₦160.48 billion. Nigeria’s ongoing economic challenges, including high inflation and currency devaluation, significantly impact operational costs. As a result, Nigerian Breweries has seen finance costs skyrocket by an alarming 281.5% to ₦72.04 billion.

Third Quarter Losses and Management Response

In the third quarter alone, the company faced pre-tax losses that exceeded sevenfold compared to the same period last year, jumping from ₦10.13 billion to ₦86.65 billion. Such a trend raises serious questions about the company’s long-term viability if these issues continue.

The management attributes these financial challenges to rising input costs driven by inflation and adverse foreign exchange conditions affecting many sectors in Nigeria. To combat these pressures, the company raised product prices twice during the reporting period.

Operational adjustments have also become necessary as two of its nine production plants temporarily halted operations due to economic challenges. These decisions reflect a strategic response aimed at maintaining efficiency while navigating financial turbulence.

Future Outlook and Strategic Moves

Despite these hurdles, Nigerian Breweries remains focused on restoring its balance sheet health. Recently, it undertook a capital raise through a rights issue amounting to ₦600 billion, which closed just a week ago. This move aims to strengthen its financial position and reduce exposure to foreign exchange risks moving forward.

Hans Essaadi, Managing Director/CEO of Nigerian Breweries, expressed cautious optimism regarding future performance despite current economic conditions. He noted that the business has shown resilience amid adversity and emphasized strategic pricing and innovation as key drivers behind revenue growth during this tumultuous period.

Increased Operational Costs

The financial results also reveal that selling and distribution expenses increased by 40.9% to ₦143.10 billion while administrative expenses rose by 50.7% to ₦37.76 billion. These increases further illustrate how external economic pressures translate into higher operational costs for Nigerian Breweries.

As Nigerian Breweries navigates these turbulent waters, industry analysts will closely monitor how effectively it can adapt its strategies in response to ongoing economic challenges. With inflation continuing to exert pressure on raw material costs and currency fluctuations affecting profitability, maintaining operational stability will be crucial for future success.